Purchasing Real-estate For Novices

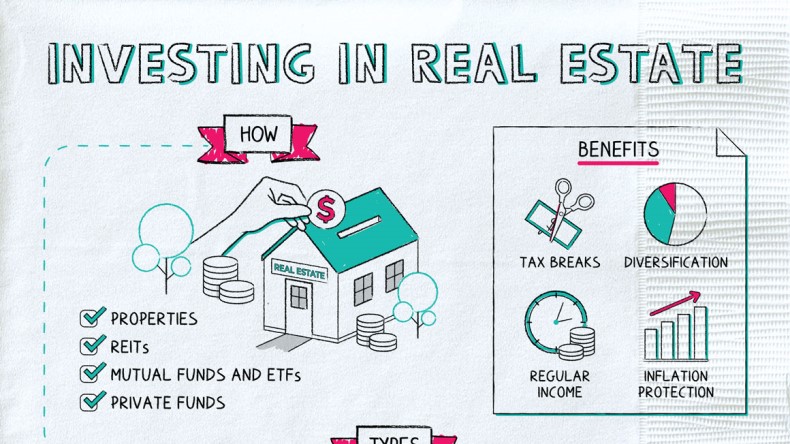

Real estate purchase has always been recognized as an effective technique for constructing prosperity, but first-timers might find it overwhelming to navigate its complexities and make long lasting returns.

Beginners looking to reach their monetary objectives can explore rookie-friendly making an investment techniques with our suggestions, tips and terminology to obtain them started.

1. Real Estate Purchase Trusts (REITs)

REITs provide traders a substitute means for making an investment in real-estate without having the top set up funds necessary to purchase house straight, with lower initial investments than directly acquiring property specifically. REITs are businesses that personal, function or finance cash flow-generating property across a variety of market sectors - typically publicly traded - supplying brokers with diverse property resources at reduced minimal expense amounts than getting personal qualities specifically. Buyers can choose either collateral REITs which very own actual physical real estate property straight themselves home loan REITs which hold lending options on real estate property or hybrid REITs which make investments both real estate investing simplified kinds.REITs provides your stock portfolio with diversification advantages while they have decrease correlations to stocks and bonds than their classic alternatives, even though they're not economic depression-confirmation it is therefore best if you talk to your economic expert about how much of your collection ought to be dedicated to REITs depending on your danger endurance and objectives.

These REITs give brokers a chance to revenue through dividends that are taxed as carry dividends, but traders should keep in mind REIT dividends might be impacted by factors such as transforming rates of interest and changes in the real estate market.

Depending on the sort of REIT you pick out, it is crucial that you just investigation its financial past and current performance making use of SEC's EDGAR system. Just before making a choice to get or offer REIT reveals, seek advice from a certified broker or economic advisor who are able to provide up-to-date marketplace knowledge and manual a well informed selection - by doing this making sure you're getting best results on your assets.

2. Real Estate Expenditure Groups (REIGs)

Like a newbie to real estate committing, the knowledge could be both pricey and intimidating. By becoming a member of a REIG you possess an chance to pool both money and time with other buyers so that you can reap earnings swiftly with little operate necessary on your part. REIGs are available both locally or over a national size and function differently some charge account fees although some don't also, diverse REIGs need various levels of member involvement with a bit of possessing one coordinator who controls every little thing although other may operate much more as partnerships.No matter which REIG you select, it is extremely important to conduct substantial research before investing. This can entail doing job interviews and asking them questions of firm staff members in addition to looking at previous earnings. You should also overview what purchase approach your REIG pursues - are they dedicated to turning components rapidly or are they looking at long-term cashflow generation through lease house ownership?

Just like any sort of expense, REIGs may either benefit or harm you financially to discover one appropriate in your distinctive financial situation and threat patience is essential.

If you're curious about enrolling in a REIG, commence your research on the web or via referrer using their company brokers or skilled professionals. Once you find an attractive group of people, take time to speak with its coordinator and comprehend their goals and threats as well as capitalization amount (otherwise known as "cover") into position - this rate aids compute expenditure property ideals and should engage in an important role when creating judgements about enrolling in or departing an REIG.

3. Real Estate Property Syndication

Real estate syndications allow brokers to achieve contact with the market without being burdened with house growth and control duties with an ongoing schedule. Real estate property syndications requires an LLC framework made up of a lively recruit who handles investment capital elevating, purchase, company planning certain assets indirect traders acquire distributions according to a waterfall construction with initial money contributions becoming dispersed back and later handed out in accordance with a perfect give back target (like 7% internal price of come back (IRR).Brokers also enjoy tax positive aspects within the expenditure package. Each year, they are provided a Timetable K-1 demonstrating their income and loss for that syndication, and also devaluation write offs on account of expense segregation and faster depreciation of property.

Purchase trusts might be ideal for first-timers due to their reduce measure of risk in contrast to direct residence purchases. But keep in mind that chance amounts be determined by each situation according to factors like the local industry, residence sort and business strategy.

To make an educated determination about making an investment in real estate syndications, it's necessary that you execute research. This means analyzing trader supplies such as venture exec summaries, full investment overviews, investor webinars and recruit team keep track of documents. When ready, reserve your home inside the offer by signing and examining its PPM verify documentation standing prior to wiring money into their accounts.

4. Home Flipping

Home flipping is definitely an excellent way for novice property investors to transform revenue by buying very low and marketing high. Even though this task will take considerable time and job, if done properly it may demonstrate highly worthwhile. Getting components with solid potential profit in areas people desire to stay is extremely important here additionally enough resources also must be put aside in order to complete remodelling of said property.Consequently, possessing a obvious strategic business plan is very important for determining your objectives and devising an activity plan to complete them. Furthermore, possessing one may serve as a useful resource when looking for buyers business plan templates available on the web may help with creating one easily.

Commencing little may help you ease into this sort of expenditure much more easily, and will allow you to familiarize yourself with its complexities quicker. A solid help community - such as companies, plumbers, electricians and so on. is going to be vital.

Rookie property traders may also take into account REITs, that are firms that personal and manage numerous attributes like hospitals, industrial environments ., shopping malls, and non commercial complexes. Since they buy and sell publicly in the carry exchange they create them readily available for starters.

Real estate property committing could be highly gratifying if you do your homework and follow these tips. Considering the variety of available alternatives, there should be one excellent for you - but be wary not to overextend yourself financially prior to being ready otherwise it might lead to debt that cannot be repaid.

5. Home Hacking

Property hacking is surely an approach to real estate property that concerns acquiring and after that leasing back a area of the acquired residence to renters, offering newbies with the perfect way to enter the market without committing excessive advance. Month-to-month lease income should deal with home loan repayments so it will help swiftly build collateral.House hacking can also provide an outstanding ability to familiarize yourself with becoming a property owner, since you will package directly with renters. Even so, be conscious that home hacking is definitely an volatile expense strategy sometimes hire earnings won't include home loan payments completely each month. Prior to diving in headfirst using this shelling out strategy it is crucial that extensive researching the market be executed.

House hacking gives another advantage by supporting minimize or perhaps eradicate property costs altogether. For example, investing in a multifamily property which contains additional products you may rent out can make surviving in it cheaper when somebody else will pay your home loan payments immediately.

Residence hacking requires living in the property you rent for that reason it is essential that you enjoy living there long term and feel comfortable in your surroundings. Furthermore, it's necessary that you think of simply how much function hiring out a number of getting started in real estate investing with no money devices at home will demand, for example verification possible renters, collecting rent payments monthly payments and controlling tenant concerns.